Understanding our 2020 annual results

Letter to shareholders N°124

Overall, during this exceptional year, we demonstrated our ability to adapt and the resilience of our businesses. We ended the year with an increase in the level of capital and a very robust liquidity situation. During H2, we were also able to define ambitious and value-creating strategic trajectories for our businesses. We have therefore established sound foundations on which we will build our future.

-

Dear shareholders,

In the still uncertain and challenging times that we are living through, I hope first of all that you and your loved ones are well. 2020 was marked by an unprecedented health crisis that impacted our lives, our economies and our companies. Throughout the last few months, our teams have been exceptionally committed in supporting our customers. For example, in France, we granted EUR 18 billion of State Guaranteed Loans (PGE) and received more than 98,200 applications from our corporate customers. We were also able to adapt our working arrangements, enabling us to ensure business continuity in order to serve our customers while protecting the health of our employees.

The Q4 results provide further confirmation of the rebound in the performances of our businesses already observed in Q3. In a challenging environment, our French and International Retail Banking activities proved resilient, growth was solid in Financial Services and the Financing & Advisory businesses and Global Markets provided further confirmation of the gradual normalisation of its performances. At the same time, we maintained strict discipline in the management of our costs and continued to implement a prudent provisioning strategy. We generated underlying Group net income of EUR +631 million and reported Group net income of EUR +470 million in Q4.

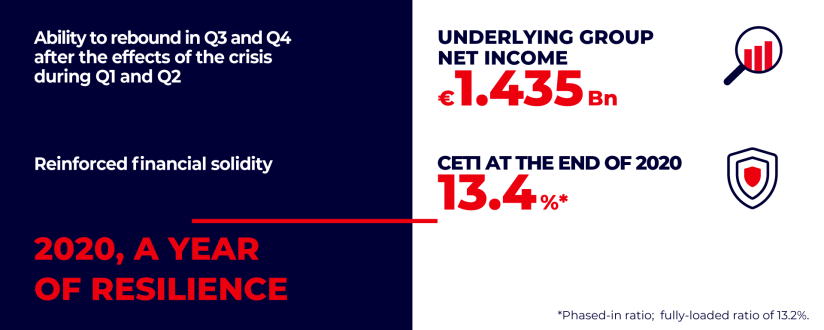

More generally, 2020 was a very mixed year for the Group. We experienced a challenging H1, adversely affected to a significant extent by the impacts of the crisis due primarily to the sudden shutdown of our economies and shocks on the financial markets. These impacts resulted in nil underlying net income and an accounting loss given exceptional impairments of goodwill and deferred tax assets. In contrast, H2 was characterised by the improved performances of all our businesses and a robust profit. Underlying net income totalled EUR 1.4 billion in 2020, with the reported result being a loss of EUR 258 million. In 2020, our costs declined and our cost of risk was under control, including also substantial provisions to cover potential defaults in 2021 and 2022 and reflecting the quality of our loan portfolio.

Overall, during this exceptional year, we demonstrated our ability to adapt and the resilience of our businesses. We ended the year with an increase in the level of capital and a very robust liquidity situation. During H2, we were also able to define ambitious and value-creating strategic trajectories for our businesses. We have therefore established sound foundations on which we will build our future.

We are pleased that the European supervisor has enabled us, like other European banks, to resume the payment of a dividend. We will therefore propose the payment of a dividend of EUR 0.55 per share in cash to the General Meeting on May 18th. The amount is calculated in accordance with the maximum recommended by the European Central Bank (ECB). We also intend to launch a share buy-back programme in Q4 2021 for an amount equivalent to the amount assigned to the dividend payment (around EUR 470m), subject to the non-renewal of the ECB’s recommendation and the authorisation for its implementation. This share buy-back would contribute to increasing earnings per share over the coming years.

While remaining conscious of the still high level of uncertainty regarding the health and economic environment, we are entering 2021 with confidence and determination, being convinced that it will be a year that sees a rebound in our financial performances and with, as a priority, the execution of our strategic initiatives. Among these, I will mention in particular the merger of our Societe Generale and Crédit du Nord networks which will enable us to increase firstly our service quality and therefore the satisfaction of our customers, and secondly the efficiency of our networks, or Boursorama’s ambitious development plan.

Finally, consistent with our raison d’être, we will continue to support our customers in emerging from the crisis and in all the transformations accelerated by this crisis, more specifically the transformations around digital technologies and corporate social responsibility issues. These are two central themes in our strategy. Our commitment to responsible finance is recognised by the extra-financial rating agencies and we wish to strengthen our leadership position in this area. We also want to remain at the cutting edge of digital technology use to enable easier and smoother access to our services.

I would like to thank you again for your loyalty and the trust you have placed in our Group as well as your long-term commitment alongside us.

Frédéric Oudéa

Chief Executive Officer

Our Q4 and full year 2020 financial results

Q4 2020 Financial Results Press Release (PDF - 614.37 KB)Strategy

Frédéric Oudéa, Chief Executive Officer, presents the new strategic plan for the Retail Bank in France

Watch the video on YouTubeLatest news

Societe Generale: Launch of a unique savings solutions offer by strengthening the partnership set-up

Read the Press Release

Renewals and appointments of Board members proposed to the General Meeting to be held on 18 May 2021

Read the Press ReleaseExpert view

Commitments

Positive transformations