Extra-financial ratings and reporting

An extra-financial rating agency evaluates the Environmental, Social and Governance (ESG) policy of economic actors.

As a guarantee of the reliability and transparency of its CSR ambition and achievements, Societe Generale strives to obtain the best possible ratings from the extra-financial agencies to which the Group responds.

They enable us to benchmark our peers and help our stakeholders in their decision-making.

What are extra-financial ratings?

The extra-financial rating is an evaluation of the company based on criteria beyond pure financial performance: respect for the environment, social and societal values, governance, etc.

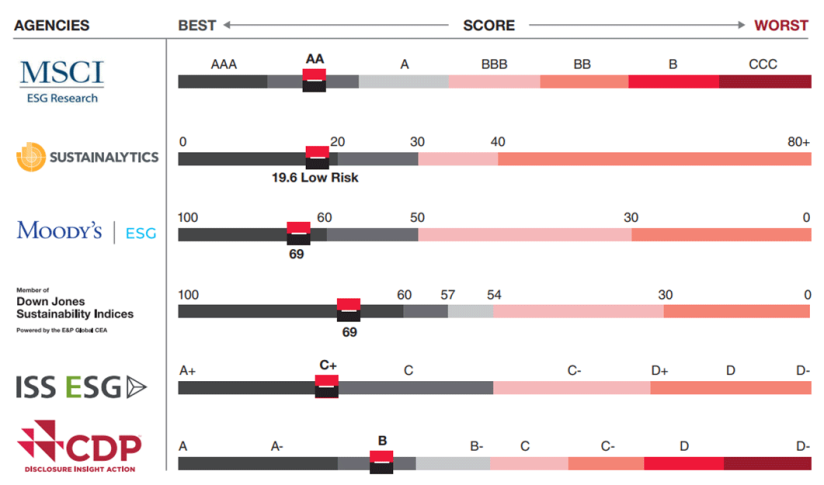

In 2023, Societe Generale continued to strengthen these ratings.

NB: ratings represent those allocated at annual reviews.

Number of companies in each agency universe: MSCI – 201 banks; S&P CSA – 736 banks; Sustainalytics – 366 banks; Moody’s ESG Solutions – 4,882 companies; ISS ESG – 285 banks.

A key player in sustainable development

Societe Generale is currently included in the main sustainability indices:

- DJSI (Europe)

- FTSE4Good (Global and Europe)

- Bloomberg Gender Equality Index

- Refinitiv Diversity and Inclusion Index

- Euronext Vigeo (Europe and Eurozone)

- STOXX Global ESG Leaders indices

- MSCI Low Carbon Leaders Index (World and Europe)

The Group is also present in a significant number of SRI (Socially Responsible Investment) funds.

A dedicated area for extra-financial analysts

Visit our publications and documents page as well as Responsibility section for all the available documents relating to the commitments of Societe Generale group with regards to societal and environmental responsibility and sustainable development.

As required under its regulatory and contractual obligations, the Group regularly publishes information on its actions in relation to corporate social responsibility. A summary published in Universal registration document provides a brief description of these publications and the links to access them.

Reporting methodology

Every year, Societe Generale performs a quantitative evaluation of its CSR key performance indicators. This reporting is coordinated by the Group’s CSR Department, which has reported to General Management since 1st January 2022 and in conjunction with the Finance Department. For social and environmental data, the bulk of the quantitative indicators are collected by each Group entity using the Planethic Reporting tool. For business, SPI (Sustainable and Positive Investments) and SPIF (Sustainable and Positive Impact Finance) data, collection from each Group entity is carried out by the Group Finance Department teams. Other data is collected directly from the CSR officers of the business divisions or from the relevant departments by the Finance Department.

Download the Note on methodology