Understanding our first quarter 2021 results

Letter to shareholders n°125

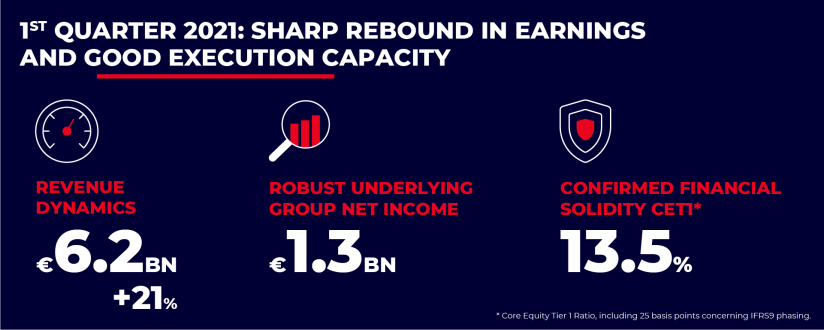

This very good start to the year marks a major milestone for our Group which is approaching 2021 with confidence and determination. The sharp rebound in our revenues, strict cost control and good risk management have resulted in a significant recovery in our earnings and profitability.

-

Dear shareholders,

In this still uncertain environment on the health and economic front, I hope first of all that you and your loved ones are well. In line with 2020, our teams maintained their exceptional commitment to supporting our economies and our customers this quarter. In all the countries where we are present, we are working alongside them to support them in emerging from the crisis, which is gradually taking shape. In particular, we are essential conduits for the support plans launched by governments, for example in France through the State Guaranteed Loans (Prêt garanti par l'État, or PGE) and, most recently, Recovery Participatory Loans (Prêts Participatifs Relance).

The very good start to the year by our Group marks a major milestone and enables us to approach 2021 with confidence and determination. This first quarter was characterised by a sharp rebound in our revenues, in keeping with the two previous quarters. Global Banking and Investor Solutions saw its businesses, first and foremost Global Markets, turn in an excellent performance. In addition to particularly favourable market conditions, we successfully completed the repositioning of our structured product activities, confirming the relevance of the decisions taken in 2020 and their effective implementation. Concerning our French and international retail banking activities, they demonstrated their resilience despite still mixed public health and economic situations. Financial Services to Corporates continued to enjoy a robust commercial momentum.

We also strictly controlled our costs despite the significant increase in variable costs related to the increase in revenues and the substantial increase in our contribution to the European Single Resolution Fund. Finally, we have provided further confirmation of the robustness of our balance sheet and the quality of our loan portfolio, with a low cost of risk in all our businesses and geographical regions and a very high level of capital.

Overall, the sharp rebound in our revenues, our continued cost discipline and good risk management resulted in a very significant recovery in our earnings and profitability this quarter. The Group generated underlying net income of €1.3 billion, reported net income of €814 million and profitability (underlying ROTE) of 10.1%.

At the same time, we are progressing in the execution of our strategic initiatives which are substantial value creators over the medium/long-term. In France, we are working on our plan to merge our two networks, Societe Generale and Crédit du Nord. In parallel, our online bank Boursorama, an alternative model and leader in digital banking, is pursuing its expansion plan and achieved record client onboarding in Q1 with 203,000 new clients. In International Retail Banking & Financial Services, we continue to develop our growth drivers. Accordingly, with regard to the mobility businesses, our subsidiary ALD Automotive, in addition to organic growth, continues to make targeted acquisitions and form long-term partnerships in line with its strategic plan. With regard to Corporate and Investment Banking, we are implementing a sustainable and disciplined growth trajectory based on our high added value expertise for our clients as part of their own transformation and development.

This quarter also marked the strengthening of our leadership position in the energy transition and the concrete implementation of our commitments. We are continuing to reduce our fossil fuel (coal, oil and gas) financing and conversely accelerating our contribution to the development of renewable energies. We are among the pioneer banks that have decided to join two groups of international institutions created recently, the Net-Zero Banking Alliance and the Net-Zero Asset Owner Alliance. Through this initiative, we are making a major commitment to include all our financing and investment activities in a trajectory of carbon neutrality by 2050.

Over the next few quarters, our priority will remain firstly supporting our customers in emerging from the crisis, relaunching their activity and transforming their business models to meet the digital and CSR challenges and secondly, effectively implementing our growth, innovation and operational efficiency initiatives which are value creators.

I would like to thank you again for your loyalty and the trust you have placed in our Group as well as your long-term commitment alongside us.

Frédéric Oudéa

Chief Executive Officer

Financial results

Latest news

Societe Generale has entered into exclusive negotiation with Amundi with a view to disposing of the asset management activities operated by Lyxor

Read the Press ReleaseShareholders’ Meeting

The Shareholders’ Meeting will be held on 18 May, 2021 at 4pm, without the physical presence of shareholders. Available in video on this website, live or as a retransmission, it can also be followed by telephone

Find out more about the Shareholders’ Meeting 2021

Given the public health context, only remote voting will be available. Shareholders voting online are able to ask questions during the General Meeting, after registering in advance on the internet site VOTACESS

How to participate and vote at the General Meeting?

In accordance with the French PACTE Law, employee shareholders will have a representative on the Board of Directors. Employee shareholders are invited to vote for one of the two candidates: Hélène Crinquant or Sébastien Wetter

Find out more about the candidatesExpert view

CLIMATE COMMITMENTS: Societe Generale joins the Net-Zero Banking Alliance as a founding member, and undertakes to align its portfolios with trajectories aiming at carbon neutrality by 2050