Understanding our first quarter 2022 results

Letter to shareholders n°130

Our Group enjoyed a very good first quarter and thereby confirmed the robustness and resilience of its business model in an environment marked by substantial uncertainty related to the geopolitical and economic context.

-

Dear shareholders,

Our Group enjoyed a very good first quarter and thereby confirmed the robustness and resilience of its business model in an environment marked by substantial uncertainty related to the geopolitical and economic context.

Our revenues increased by more than 16%(1)in the quarter, with a solid performance by all our businesses, particularly in Global Markets, Financial Services and Financing & Advisory. Good cost control resulted in a significant improvement in our underlying cost to income ratio(2), by nearly 7 points to 56.4%. Driven by a very positive jaws effect, our underlying gross operating income grew substantially, by nearly 38%, to EUR 3 billion. Over the period, our cost of risk remained contained, at 39 basis points and around 31 basis points excluding the Russian assets currently being sold. Group net income totalled EUR 1.57 billion on an underlying basis (+21.3%) and EUR 0.84 billion on a reported basis. The Group’s profitability (ROTE) stood at 11.9% on an underlying basis in the quarter.

The current crisis in Ukraine has caused an upheaval resulting in a radical and lasting change in the prospects for collaboration with Russia and we have decided to withdraw from this market. As a result, on April 11th our Group announced the ending of its banking and insurance activities in Russia and the signing of a sale and purchase agreement to sell its entire stake in Rosbank and the Group’s Russian insurance subsidiaries, to Interros Capital. This agreement would enable the Group to withdraw in an effective and orderly manner, ensuring continuity for both its employees and its customers. This disposal would have an impact of around EUR 3.1 billion on the P&L at closing of the operation but would have a limited residual net impact on the Group’s capital.

With a solid capital base and a CET1 ratio of 12.9%(3), well above the regulatory minimum, the Group has confirmed its distribution policy for 2021 which breaks down into a dividend in cash, proposed to the General Meeting, of EUR 1.65 per share and a share buyback programme(4), for around EUR 915 million, equivalent to EUR 1.1 per share.

Over the last few months, the Group has achieved important milestones in the implementation of its strategic initiatives: signing of the framework agreement for the planned acquisition of LeasePlan by ALD; signing of a definitive partnership agreement between Boursorama and ING; continuation of the planned merger of our retail banking networks in France with the presentation of the new system of brands and the conclusion of key agreements in terms of human resources; and finally, the acceleration of our ESG ambitions. The Group places ESG issues at the heart of its strategy and this commitment is recognised by the non-financial rating agencies and key market players. Accordingly, last month the bank was named Bank of the Year for Sustainability by International Financing Review (IFR).

Through in particular the numerous strategic initiatives already undertaken, 2022 is a pivotal year for the Group in the evolution of its business model. The Societe Generale and Crédit du Nord networks in France are preparing for their legal merger on January 1st, 2023, under the Vision 2025 project. This key milestone is part of the ambition to become the relationship bank of reference. Boursorama intends to accelerate its client onboarding with a target of 4 to 4.5 million clients by end-2022, one year ahead of its initial target, and strengthen its position as the undisputed leader in online banking in France. In the mobility sector, we have the ambition to finalise the planned acquisition of LeasePlan by ALD by year-end, thereby creating a leading global player in mobility. With these projects, the Group is putting in place the conditions for sustainable, profitable and value-creating growth.

I would like to thank you again for your loyalty and the trust you have placed in our Group as well as your long-term commitment alongside us.”

Frédéric Oudéa

Chief Executive Officer(1)16.6% in absolute terms and 16.1% when adjusted for changes in Group structure and at constant exchange rates

(2)Excluding contribution to the Single Resolution Fund

(3)Phased-in ratio

(4)Subject to usual approvals from ECB and Combined General meeting

Strategy

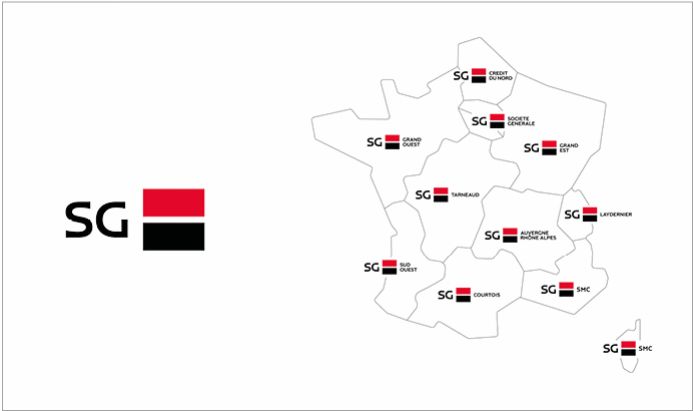

Societe Generale and Crédit du Nord have marked another step forward in their networks merger project with the announcement of the new branding and the appointment of future Regional Directors

Read the Press Release

On 4 April 2022, Boursorama signed a definitive partnership agreement with ING to offer ING's online banking customers in France the best alternative banking solution

Read the press release

Following the announcement of the proposed acquisition by ALD of LeasePlan, the signing of the framework agreement on 22 April 2022 is another major milestone towards creating a leading global player in mobility

Read the press releaseNews

On 11 April 2022, Societe Generale announced the ending of its activities in Russia and the signing of an agreement to sell Rosbank and its Russian insurance subsidiaries to Interros Capital

Read the press release

Societe Generale named “Bank of the Year for Sustainability” by the International Financing Review

Find out moreAnnual General Meeting

Organized on 17 May 2022, at 4 p.m., at Hall 5.1 - Porte de Versailles in Paris, the Annual General Meeting will also be broadcast on video, live and recorded for delayed viewing via Group’s website

Find out more about the 2022 Annual General Meeting

To vote at the General Meeting several methods are possible: personally attend, vote by post, vote online and vote by proxy

Find out moreEnvironmental commitments

Societe Generale Assurances strengthens its commitment for the environment and the preservation of biodiversity

Read the press release

Greenlink Interconnector will connect the power markets of Ireland and Great Britain. This is one of Europe’s most important energy infrastructure projects

Find out more about the project and the support of Societe Generale

Green mobility: Meridiam partners with Carrefour to offer a complete range of EV charging stations

Find out more about this financing, which has been awarded a «Green loan» label

Societe Generale, one of the founding members of the Working Group to support aviation industry decarbonization